Your New Mexico Property Deserves Full Compensation

We know choosing a New Mexico public adjuster can feel uncertain. That’s why we offer free claim reviews to homeowners and business owners across the state. With a 97% success rate and hundreds of approved Albuquerque insurance claims, we’ll show how much more your insurer might owe you.

There’s no risk — just expert guidance from a property loss adjuster in NM who understands how local insurance companies operate and how to get you the payout you deserve.

Relax. Let our New Mexico public adjuster deal with your insurance company for you.

On-Site Fire Damage Review

Our New Mexico public adjuster visits your property, documents every detail, and prepares a complete damage report based on true local repair costs — not the insurer’s low estimate.

Direct Negotiation with Insurance Companies

We handle all discussions with your insurance provider, challenge underpaid estimates, and secure full compensation for your property losses.

Get Paid and Rebuild Faster

Once your claim is settled, we make sure payment arrives quickly so you can rebuild and recover without delay or stress.

97% Success Rate in New Mexico Insurance Claims

On average, our clients receive a 712% larger payout on their insurance claims

From Albuquerque to Santa Fe, our clients recover significantly higher settlements with a New Mexico public adjuster advocating on their behalf.

The best part? This is completely free until the insurance company pays you!

Trusted Public Adjuster Serving Homeowners and Businesses Across New Mexico

When property damage strikes, your insurance company isn’t focused on helping you recover. They’re focused on minimizing what they pay.

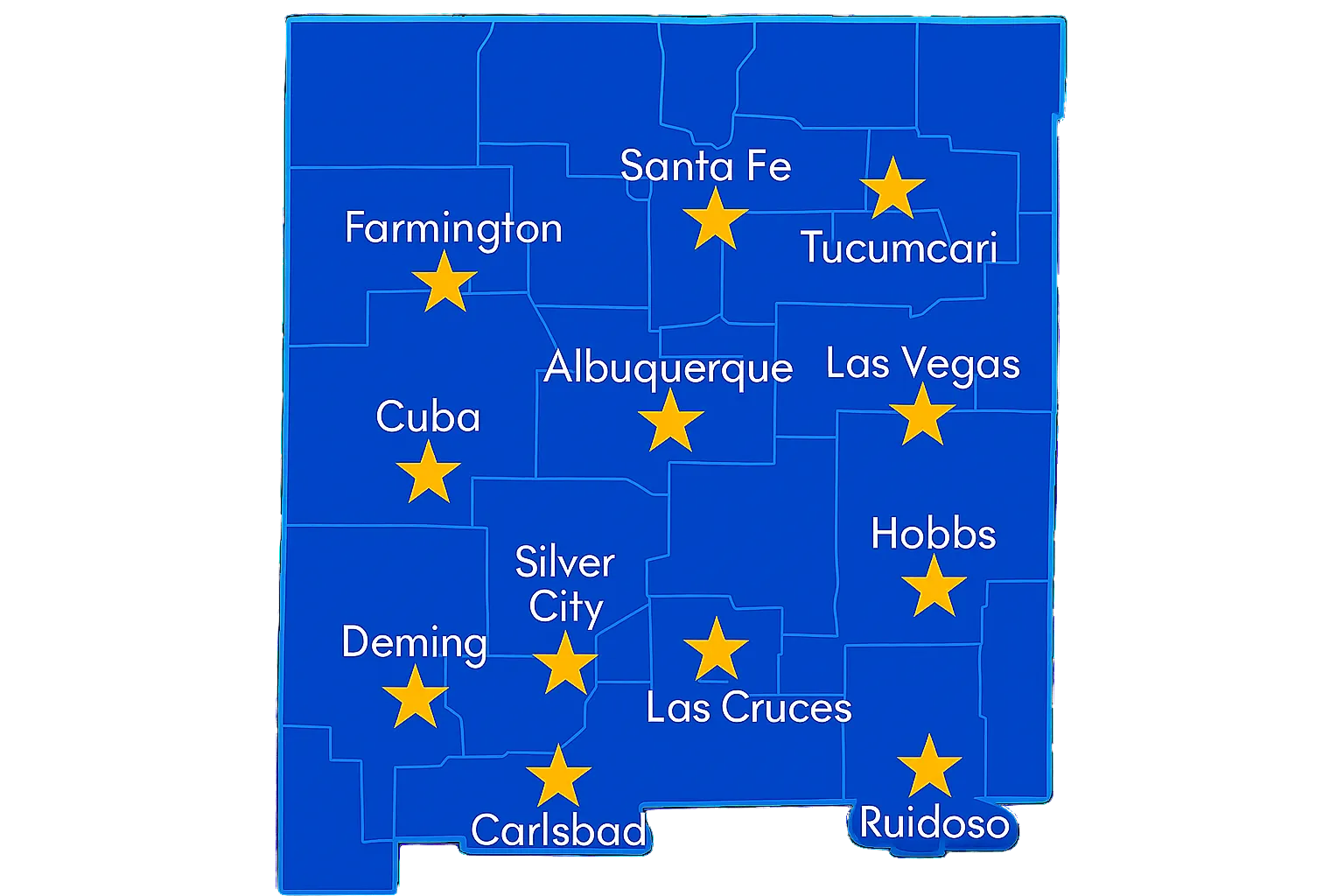

At Claim Warrior, your New Mexico public adjuster ensures you get fair and full compensation. We represent homeowners and business owners across Albuquerque, Santa Fe, Las Cruces, and beyond.

With over 30 years of combined experience, we know every insurer’s tactics — and how to overcome them. Whether you’ve suffered hail damage in Albuquerque, fire damage in Santa Fe, or flooding in Las Cruces, our property loss adjusters in NM protect your claim from start to finish.

Why New Mexico Homeowners Trust Claim Warrior

Handling insurance claims on your own can be confusing, time-consuming, and costly. You shouldn’t have to face that battle alone.

Our New Mexico public adjusters take care of everything — assessment, documentation, and negotiations — so you can focus on restoring your home or business, not fighting with your insurer.

Here’s how we help local policyholders

Fast, Accurate Damage Assessment

From storm-hit roofs in Albuquerque to fire damage in Santa Fe, we carefully inspect every inch of your property to ensure nothing is missed in your claim.

Complete Claim Handling

We manage your claim paperwork, negotiations, and evidence submissions from start to finish — no stress, no guesswork.

Higher Settlements, Less Stress

Policyholders represented by a New Mexico public adjuster receive significantly higher payouts than those filing alone. We make sure your insurer pays every cent you’re owed.

Local Expertise in New Mexico Insurance Claims

Our adjusters understand New Mexico’s property laws, desert climate risks, and insurer procedures. From hail and fire to wind and flood damage, we know exactly how to build and win your claim.

We Handle Every Type of Property Damage Claim in New Mexico

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Getting you the most from your claim

.svg)

We Work With All Major Insurance Companies in New Mexico

We work directly with every major insurer in New Mexico — including State Farm, Allstate, Farmers, and more.

Whether you’re covered by a national carrier or local provider, your New Mexico public adjuster knows exactly how to handle their claim process — and how to make it work in your favor.

Trusted by 50,000+ New Mexico Property Owners for Over 30 Years

Claim Warriors Got My Full Payout

“They handled my claim from start to finish and got me the full payout my insurance first denied. Fast, clear, and fair.”

Fast, Professional Storm Claim Help

“After the storm, they stepped in, handled my insurer, and secured the payment I actually deserved. Super quick”

Doubled My Settlement Without Stress

“They took over the whole claim and doubled my payout. I didn’t have to deal with the insurance at all”

50,000+ New Mexico Property Owners and Counting

.svg)

“After my home was damaged by fire, I would have been lost without the help of Claim Warriors. They were diligent advocates to our claim, leaving no stone unturned. Ultimately, we were able to repair all the damage to our home, though it was a hard-won battle.”

“I turned to Claim Warriors for water damage at my property. They were highly professional and handled everything with the insurance company. I didn’t have to lift a finger. They secured an outcome that was more than triple the insurance company’s original offer. I have recommended Claim Warrior to friends.”

“Claim Warrior team was incredible in helping me settle a water claim from a pipe burst in my bathroom. When the insurance company didn’t want to pay, they stepped in, documented everything accurately, and fought a fair settlement. I couldn’t be more satisfied with the outcome!”

FAQ

It’s advisable to hire a public adjuster as soon as possible after experiencing property damage or loss. They can help from the initial claim filing to negotiating with the insurance company, ensuring you get the maximum settlement possible.

Our goal is full client satisfaction. If you’re ever unhappy with our process, we’ll review your case immediately and make every effort to address your concerns and deliver the results you deserve.

Every claim is unique, depending on the type of damage, the insurer’s responsiveness, and how quickly all documentation is submitted. Most property damage claims are resolved within a few weeks to a few months, but complex cases or disputed claims may take longer. We work to speed up the process and keep you informed at every step.

Even if you’ve received an offer, it’s wise to have it reviewed. We often find that initial offers are far below the true value of your loss — and we negotiate to recover what you’re rightfully owed.

We keep you informed at every stage of the process. You’ll receive regular updates, and our team is always available to answer questions or discuss your claim’s progress.

Depending on your policy and the extent of your damage, you may be entitled to payment for repairs, lost income, additional living expenses, and personal property replacement.

.webp)

.svg)