Roof Claim Recovered:

This roof damage claim case study demonstrates how Claim Warriors overturned a severely undervalued insurance estimate by proving functional storm-related roof damage and enforcing proper replacement scope. Through meticulous documentation and policy-driven negotiation, the final settlement increased by more than 226%.

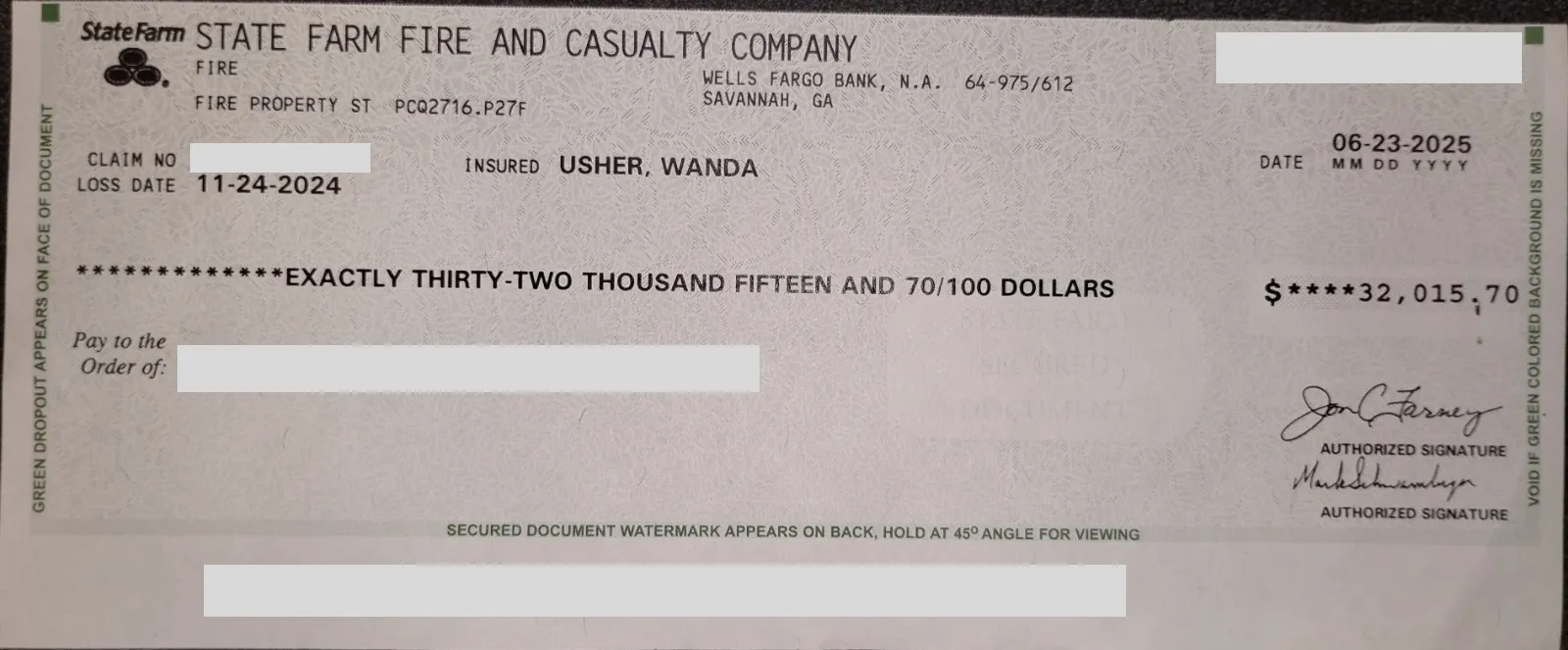

Zoom on the check info

SETTLEMENT CHECK

$14,800

$32,015

.webp)

Damage assessment

Visible damage impacting the primary living environment

“The Problem With Roof Damage Insurance Claims”

Roof damage claims are frequently underpaid because carriers often classify impact marks as “cosmetic” and deny full replacement.

Initial adjuster inspections may overlook functional hail strikes, lifted shingles, and wind-compromised fastening systems.

Claim Warriors conducts slope-by-slope inspections, brittle testing, attic intrusion checks, and photo-verified damage analysis to reveal issues missed in the first assessment.

This case shows how incomplete scoping can leave homeowners responsible for thousands in roof replacement costs that should be fully covered.

Critical Roof Damage Issues Often Missed by Insurance Adjusters

Case Background

Client Profile

Single-family residence, 1,900 sq ft, built 1990

Philadelphia, Pennsylvania

November 24, 2024

Wind damage causing shingle uplift, underlayment tearing, and water intrusion risk

Owner-occupied home

Initial Insurance Offer

The insurance carrier issued an initial offer of only $9,800, excluding full roof replacement, underlayment upgrades, code-required materials, and interior leak repairs.

Key Challenges

Claim Warriors Process & Methodology

Our four-step forensic approach to fire damage claim recovery combines technical expertise, policy knowledge, and strategic negotiation.

Forensic Inspection

Comprehensive 6-hour site inspection including thermal imaging, moisture mapping, air quality testing, and photographic documentation of all damage.

Policy Analysis

Line-by-line review of insurance policy to identify all coverage provisions, endorsements, and entitlements including code upgrades and extended living expenses.

Xactimate Estimate

Detailed estimating using industry-standard Xactimate software with proper unit costs, labor rates, and all necessary repair line items for full restoration.

Negotiation with Carrier

Comprehensive 6-hour site inspection including thermal imaging, moisture mapping, air quality testing, and photographic documentation of all damage.

Estimate & Negotiation Proof

Side-by-side comparison of the carrier's initial estimate versus Claim Warriors' comprehensive scope of work.

Carrier Estimate

Claim Warriors Scope

Roof Damage Claim Settlement Increased 226%

By conducting a full roof inspection, brittle testing, and documenting functional hail and wind damage, Claim Warriors proved that spot repairs were not viable. Using policy-supported arguments and corrected scoping, the settlement increased to $32,015.70, ensuring full roof replacement approval.

$14,800

$32,015

$22,215

226%

Proof of Recovery

Verified settlement check confirming the $32,771.93 payout (all personal information redacted).

Without professional representation, the homeowner would have been left with insufficient funding for a full roof replacement and exposed to future leaks.

Full restoration funded with zero out-of-pocket cost

Key Insights & Industry Lessons

Critical takeaways from this case that apply to fire damage claims across the insurance industry.

Insurance Estimates Frequently Undervalue Fire Losses

Initial carrier offers often omit hidden damage, code upgrades, and critical categories.

Proper Documentation Is Essential

A full forensic inspection dramatically increases claim accuracy and payout.

Policy Language Must Be Interpreted Correctly

Most homeowners are unaware of benefits they're entitled to.

Negotiation Requires Expertise

From forensic inspection to final settlement, we handle every aspect of your claim—you focus on rebCarriers rely on homeowners not knowing how to challenge estimates.uilding, we focus on maximizing your recovery.

Public Adjusters Protect Policyholders

Having Claim Warriors involved early prevents delays, denials, and underpayment.

Don't Accept a Low Settlement

If your insurance claim has been underpaid or denied, contact Claim Warriors for a free claim review. We work on a contingency basis—no upfront costs, no recovery, no fee.

226%

$18K+

9 Days

Why Claim Warriors?

We are advocates, experts, and allies for policyholders facing complex insurance claims.

Licensed in 14+ States

Fully licensed public adjusting firm serving homeowners and businesses across the United States with local expertise and national reach.

Decades of Experience

Our team has collectively handled thousands of claims totaling hundreds of millions in recovered settlements for policyholders.

Former Insurance Adjusters

We know how carriers think because we used to work for them. We understand their tactics, their estimating methods, and their pressure points.

Full Documentation & Negotiation

From forensic inspection to final settlement, we handle every aspect of your claim—you focus on rebuilding, we focus on maximizing your recovery.

Proven Claim System

Our proprietary claim methodology combines forensic science, Xactimate estimating, policy analysis, and strategic negotiation for optimal outcomes.

No Upfront Cost

We work on contingency—you pay nothing unless we recover additional funds. Our fee is a percentage of what we recover, aligning our success with yours.

Our Mission: Maximum Recovery for Every Policyholder

Claim Warriors was founded on a simple principle: insurance policyholders deserve fair treatment and full compensation for covered losses. We fight to level the playing field with forensic expertise, policy knowledge, and unwavering advocacy.

You pay nothing unless we recover additional funds for your claim

We work exclusively for you, not the insurance company

You receive copies of all documentation and communication

Average claim resolution in 30-60 days

Conclusion

This case shows how roof damage is frequently undervalued due to incomplete inspections and misclassification of wind uplift.

By applying forensic roof assessment and enforcing code upgrades, Claim Warriors secured a 121% increase and a fully covered replacement.

The lesson is clear: when facing a complex insurance claim, expert representation is not a luxury—it is a necessity. The cost of working with a public adjuster is far outweighed by the additional recovery achieved, and the peace of mind that comes from knowing your interests are being professionally advocated for.

If you are facing an underpaid or denied insurance claim, we encourage you to contact Claim Warriors for a free claim review. Our team will assess your situation, review your policy, and provide honest guidance on whether we can help maximize your settlement. You have nothing to lose—we only earn a fee if we successfully recover additional funds on your behalf.

About Claim Warriors

Our Services

Structural damage, smoke remediation, and full restoration

Flooding, pipe bursts, mold remediation, and moisture damage

Hurricane, tornado, hail, and severe weather damage

Business interruption and commercial property damage

Multi-unit properties and catastrophic damage events

Expert representation in appraisal and mediation proceedings

Protecting Property Owners from Insurance Underpayments

Claim Warriors is a multi-state public adjusting and claims management firm dedicated to protecting property owners from insurance underpayments. We advocate for homeowners and business owners—not insurance companies.

Our team includes former insurance company adjusters, licensed contractors, forensic specialists, and certified estimators. This multidisciplinary expertise allows us to document damage comprehensively, interpret policy language accurately, and negotiate settlements effectively—ensuring you receive the full compensation you're entitled to under your policy.

We have successfully recovered hundreds of millions of dollars in additional settlements for our clients across fire, water, storm, and commercial claims. Our commitment is simple: maximum recovery, transparent communication, and unwavering advocacy for every policyholder we represent. We work on a contingency basis—no upfront costs, and no fee unless we recover additional funds for you.

.svg)